Finance

Cash from Credit Card in Dubai / Abu Dhabi / Sharjah in UAE

Cash from Credit Card in Dubai / Abu Dhabi / Sharjah in UAE

here are few shops in Abu Dhabi and Dubai where one can swipe the credit card and get cash in hand by paying a certain percentage usually 2.5%-4% as a fee. These shops provide cash in hand immediately after swiping the credit card on their credit card machine. The users can then convert their purchase into an EMI if the credit card has such a feature. This can come handy when someone is in immediate need of cash, but only have credit limit on their cards.

Cash from Credit Card in Dubai

In Dubai, several jewellery shops in Satwa / Bur Dubai area provide card from cash facility, but the percentage charged is quite high – 3.5% to 4.5%. You can try and negotiate with the shop keeper to get the percentage to a more reasonable 2.5% to 3%.

Javeri Jewellery in Bur Dubai

Address: Shop #3, Al Fardan Building Meena Bazar – Al Hisn St – Bur DubaiAl Fahidi – Dubai

Map location:

Atrium Center in Bur Dubai will provide Cash from Credit Card in Dubai

Atrium Center Bur Dubai, Shaheen General Trading

Cash from Credit Card in Abu Dhabi

Disclaimer: Above addresses and information is based on personal experience of UAE residents and not from the website editors.

Disclaimer: Taking cash from credit card may be an easy way to access money, but it is strongly not advisable as credit cards might lead to financial disaster if not used with care and if not repaid fully. Do keep in mind that the credit card issuing banks will charge minimum 3.5% interest per month which will account to 42% only in interest annually.

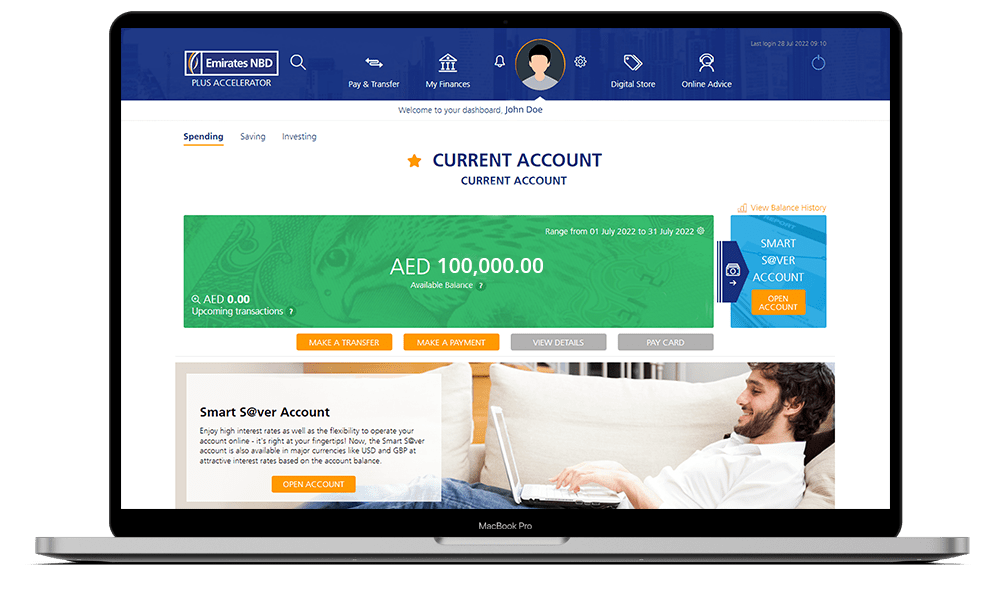

Features of Online Banking

Finance

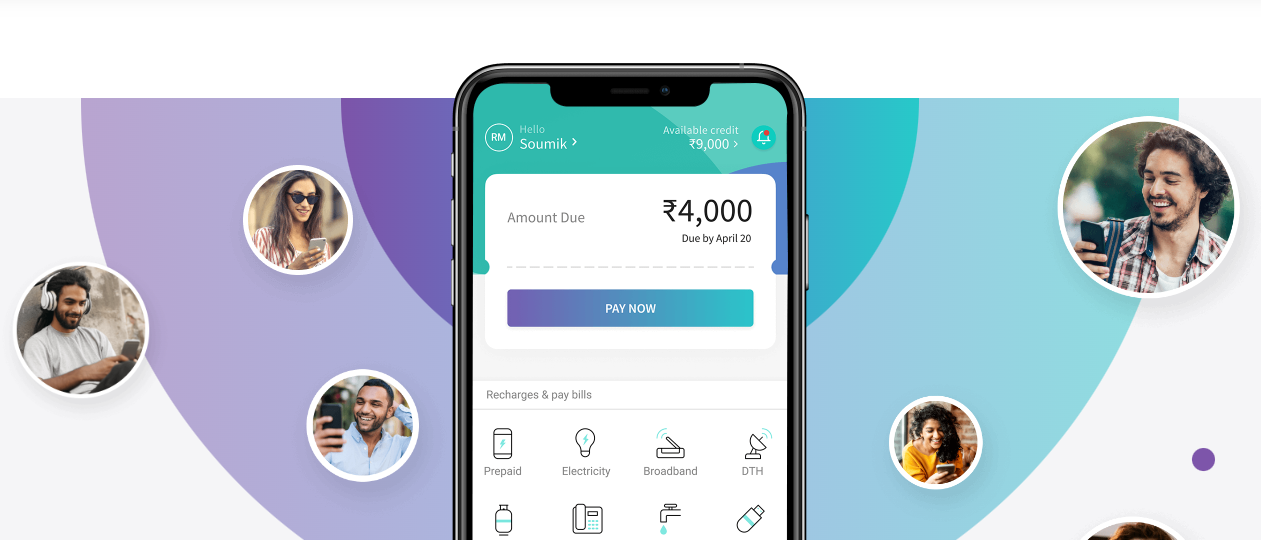

Buy anything on the internet with 1 tap. Pay later Simpl

Buy anything on the internet with 1 tap. Pay later Simpl App

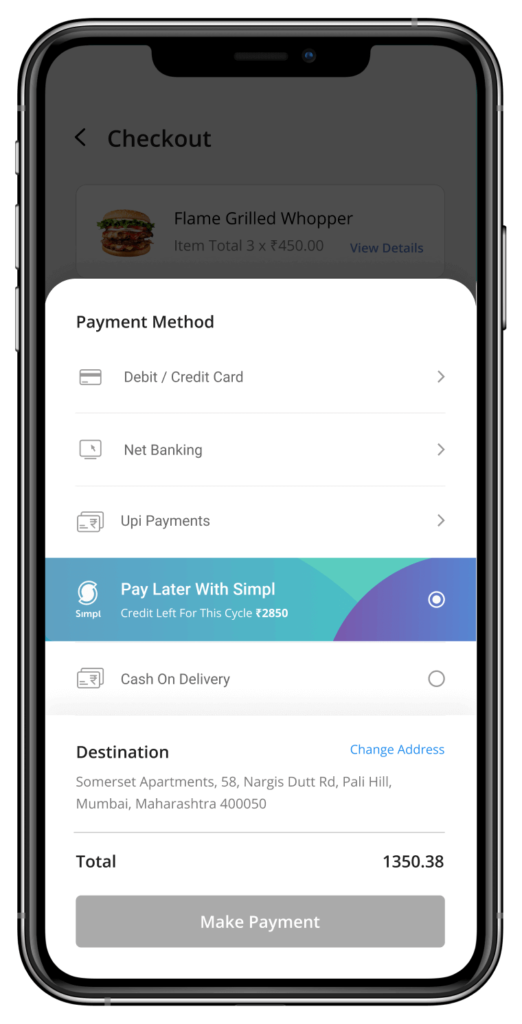

Online shopping is fast and convenient but the checkout options are not. The Simpl app brings the convenience of a khata online so you can check out with 1 tap and pay later.

A Khata for your online neighborhood.

Download Simpl and sign up to get instant account approval.

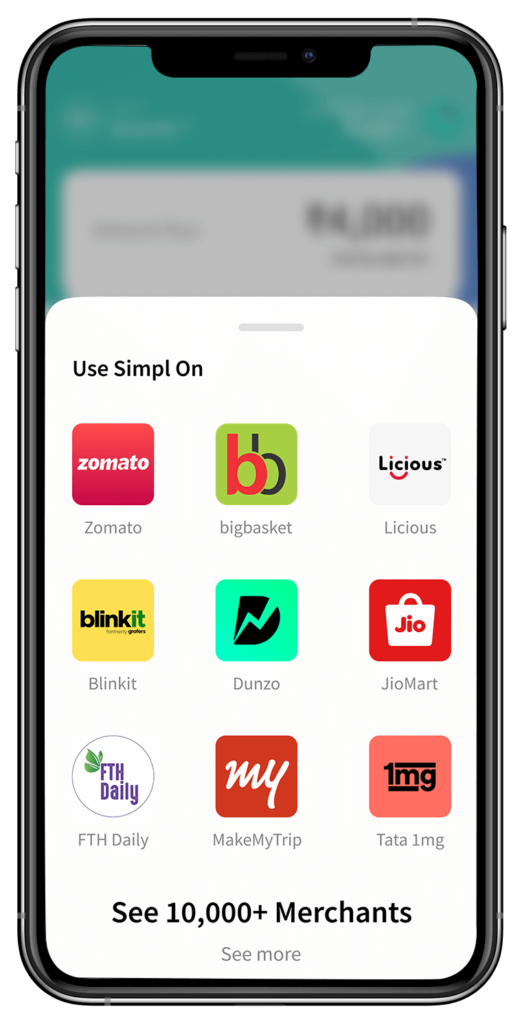

Connect Simpl to your favorite online merchants and utility companies.

Tap the Simpl button when making online purchases. Your transaction will be forwarded to your Simpl account.

Clear your Simpl balance every 15 days.

Want to start buying with Simpl?

Download The Simpl App

Faq:

1. Is Simpl Safe to Use?

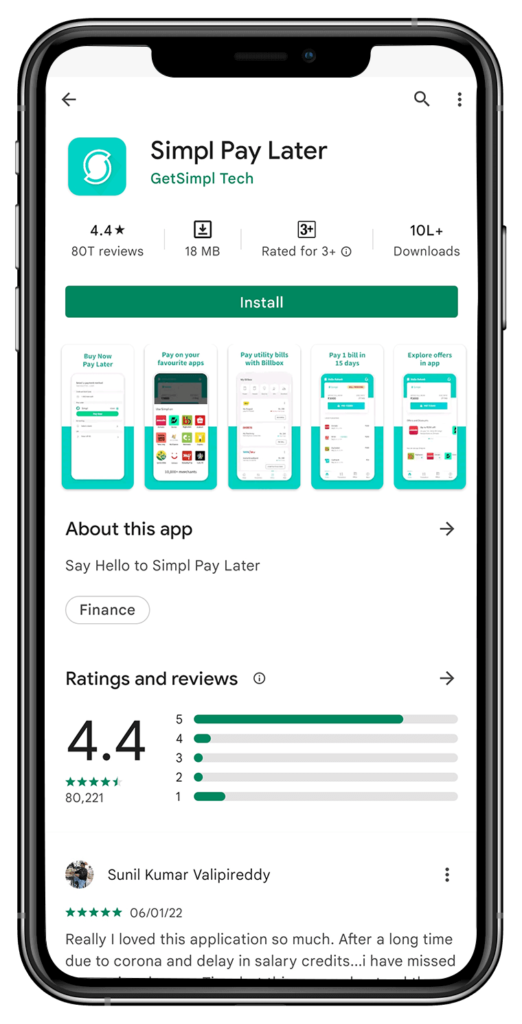

Yes, Simpl is among the most premier checkout experiences available today. Due to a network of 40 million approved users and over 1 million daily transacting shoppers, Simpl is clearly among the most trusted payment options on a network of over 26,000+ brands. Simpl uses a highly robust data and engineering model to approve users on the basis of their own proprietary scoring system without impacting customers’ overall credit history. The algorithms used in the back-end undergo an ever-evolving process of iteration, making them more nuanced and efficient each day.

Also read : EmiratesNBD credit card

In case of delinquency in bill payment, Simpl does levy a pre-decided and agreed-upon fee only on the outstanding amount and intimates its users on doing so. The buy now, pay later option on Simpl is designed for user convenience – a fact evidenced by over 5 Million downloads that the app has on its Google Play and App Store platforms.

Signing up on Simpl is quite easy and can be done in minutes. Simpl bills as well can be repaid via Autopay or UPI, which further bolsters the faith among users that their data is safe and secure on the platform. The purpose of the Simpl app can be easily explained in a few words – Simpl is a checkout network that enables merchants to build trust and form a long-term relationships with their consumers. Simpl believes in empowering merchants and users at the same time by offering ease and convenience.

2. How is my spending limit determined?

Your spending limit is initially set by default. But once you start using Simpl, the limit is constantly updated based on a few major factors.

How regularly you repay: Regular and prompt repayment is the most important factor in updating your spending limit. If you’re quick and consistent in settling your dues with Simpl, your spending limit increases over time. Needless to say, consistently failing to do so will have the opposite effect.

Your spending habits: The spending limit will mirror your purchasing habits. If your spending increases steadily, the limit will go up too.

Using the Simpl app: The Simpl app lets us carry out further verifications based on data available on the phone. For example, based on your transactional SMS messages, Simpl can increase your spending limit to match your overall spending.

The strength of your profile: A strong profile allows us to verify your identity, and get to know you better. Simpl uses this information to increase your spending limit.

3. Does Simpl do anything if someone doesn’t pay?

If a payment isn’t made by the due date, Simpl can charge a late penalty of up to Rs. 250 + applicable taxes (GST). In case a user informs us about any issue s/he is facing, we will withhold the late penalty. Or reverse it, depending on the situation.

Users are also notified multiple times via Email, SMS and other reminder notifications before the penalty is levied. We hate hidden charges as much as you.

In case you’re facing any issue, do drop us a message, and we’ll get back to you at the earliest and have it resolved.

4. How does Simpl’s billing cycle work?

Your Simpl bill is generated twice a month.

All your transactions between 1st and 15th are added into one bill, which is generated on the 15th.

All transactions made between 16th and 30th/31st are added into one bill, which is generated on, you guessed it, 30th/31st.

Of course, you can choose to pay for your transactions even before your bill is generated. You can do so by logging into your account via our website or app.

How is Simpl safer than cards and other modes of payment?

When you buy online, you have to carefully enter all your details every time. Sadly, this complicated verification process only gives you the illusion of security. In reality, the chances of fraud go up every time you share information over the internet.

With Simpl, your payment details are never passed to the merchant. By drastically reducing the number of times you give out your banking data online, we drastically reduce the chances of fraud! 🙂

How do I pay later in Simpl?

Buy anything on the internet with 1 tap. Pay later.

- Download the App. Download the Simpl app from the Android or iOS app store and sign up through the Simpl app to get instant account approval.

- Checkout with 1 Tap. …

- Shop online with 26,000+ merchants. …

- Clear your Simpl Balance.

What happens if I didn’t pay on Simpl?

Not paying your Simpl bill on time is a violation of the terms & conditions. It will lead to consequences including application of penalties up to Rs 1200, suspension of account.

Can I pay Simpl bill in installments?

Pay-in-3 allows end-customers to conveniently split their current payments into three tranches at no extra charges with a host of advantages.

Is Simpl an Indian app?

Simpl is headquartered in Bangalore, India and has a global team in 3 countries.

Personal finance and money-saving tips are popular blog topics that provide valuable information and strategies to help individuals manage their finances effectively and save money. Here are some specific subtopics within personal finance and money-saving:

- Budgeting and Expense Management: Tips on creating a budget, tracking expenses, and managing cash flow to ensure financial stability.

- Saving Strategies: Techniques to save money, such as setting financial goals, automating savings, and adopting frugal habits.

- Debt Management: Strategies for managing and paying off debt, including debt consolidation, negotiation, and prioritization methods.

- Investment and Retirement Planning: Guidance on investing wisely, understanding different investment options, and planning for retirement.

- Smart Shopping and Consumer Tips: Advice on making informed purchasing decisions, finding discounts, and utilizing coupons or loyalty programs.

- Financial Goal Setting: Tips for setting financial goals, creating a plan, and staying motivated to achieve long-term financial objectives.

- Side Hustles and Extra Income: Ideas for generating additional income through side hustles, freelancing, or online ventures.

- Insurance and Risk Management: Information on different types of insurance, their importance, and strategies for managing risk.

- Tax Planning: Tips for optimizing tax deductions, understanding tax laws, and maximizing tax refunds.

- Financial Education: Educational resources, book recommendations, and tips for improving financial literacy.

Remember, when writing about personal finance and money-saving tips, it’s important to provide accurate and up-to-date information, tailor advice to different financial situations, and emphasize the importance of individual financial goals and priorities.